Revenue Composition

Six revenue lines span poultry, duck, rabbit, and circular fertilizer outputs.

Each modality feeds the Adena network while balancing commodity risk: broilers and layers deliver steady cash flow, ducks differentiate premium supply, rabbits anchor value-add processing, and compost closes the loop for regenerative soil programs.

Figures reflect steady-state annual performance for a single Adena Poultry & Rabbit Works campus.

- Chicken broiler $1.102M annual revenue 17.9% of total

- Chicken layer (eggs) $495K annual revenue 8.1% of total

- Duck broiler $1.463M annual revenue 23.8% of total

- Duck layer (eggs) $742K annual revenue 12.1% of total

- Rabbit meat $1.92M annual revenue 31.3% of total

- Compost & fertilizer $420K annual revenue 6.8% of total

Percentages round to the nearest tenth; totals reflect steady-state performance per site.

Financial Snapshot

$6.142M

Annual revenue per site once barns, processing, and distribution operate at capacity.

$3.892M

Pre-CAPEX earnings from the integrated livestock stack (63% EBITDA margin).

$7.0M

Interest-free, seven-year amortization aligned to Fair Enterprise repayment waterfalls.

19 FTE

Average compensation ~$54.9K plus $20K in profit share through the Fair Enterprise pool.

7 years

Post-repayment net profit climbs to ~$4.89M annually, boosting all profit-share buckets.

6 primary lines

Six-line mix spanning chicken broilers, chicken layers, duck broilers, duck layers, rabbit meat, and compost products to diversify cash flow.

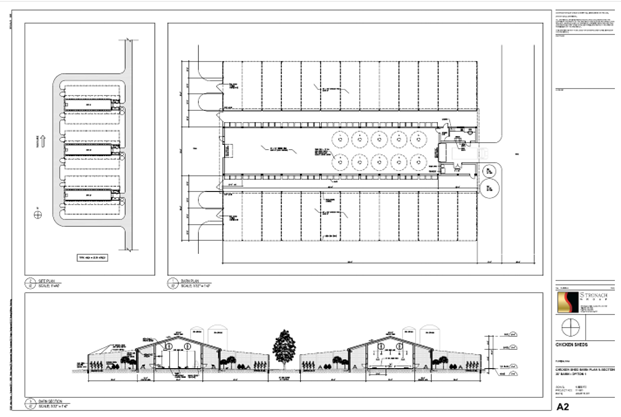

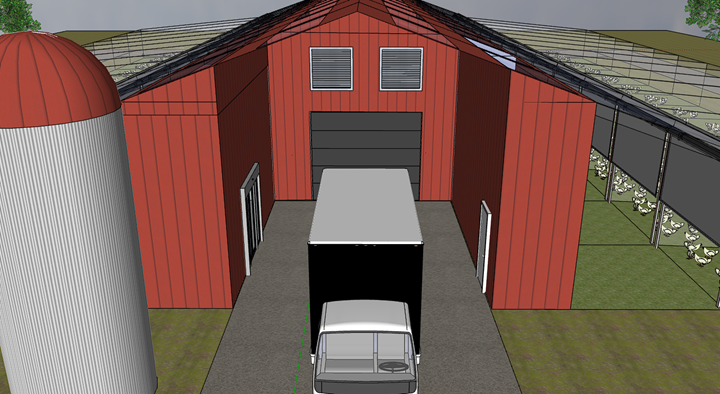

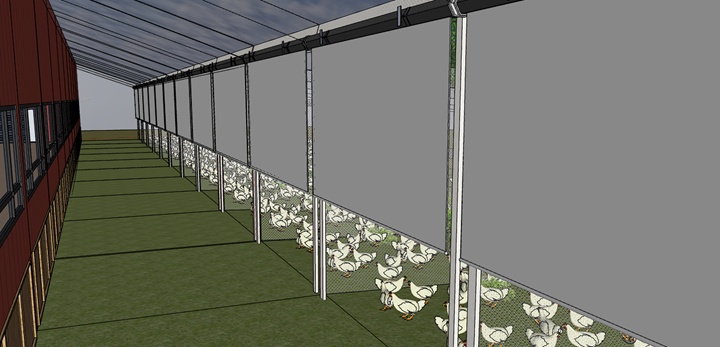

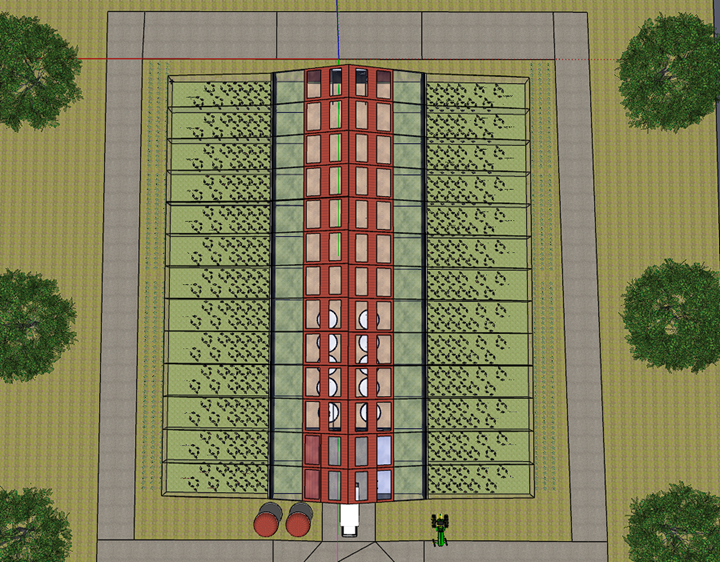

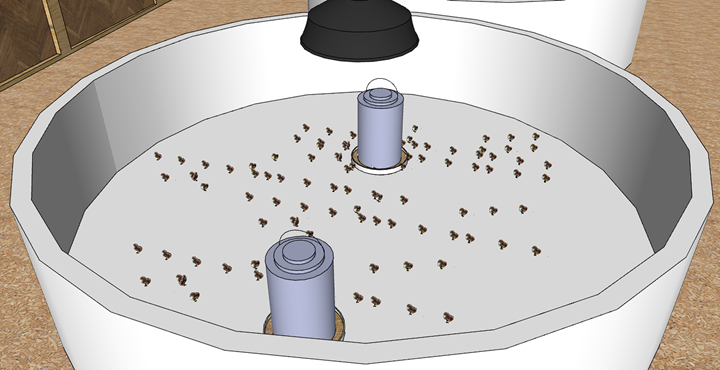

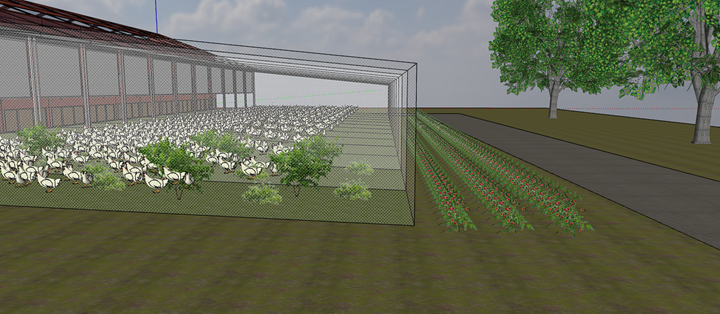

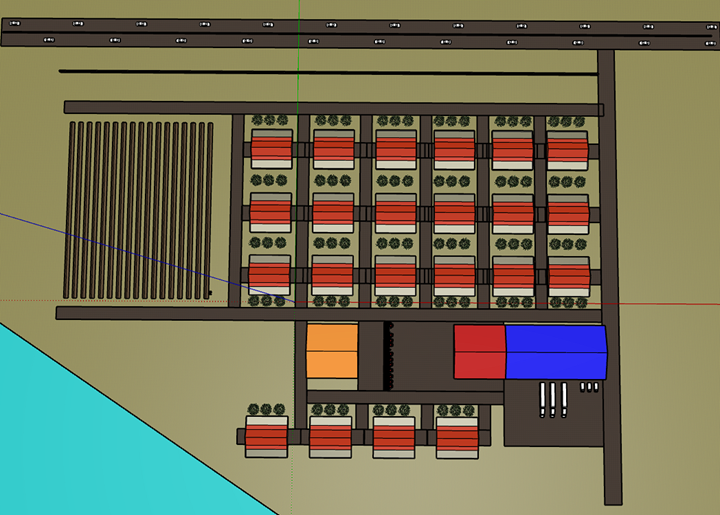

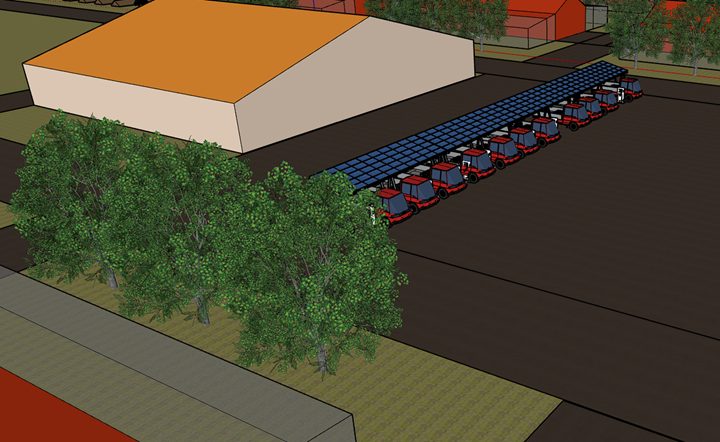

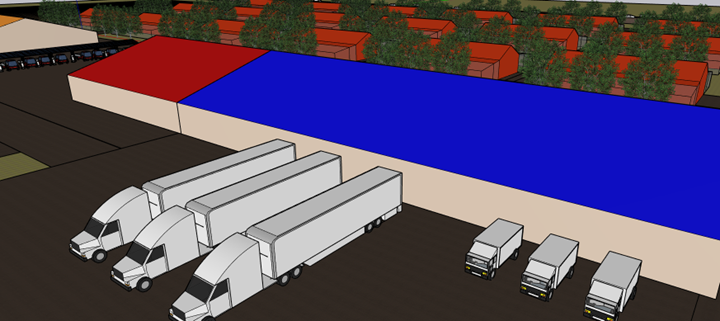

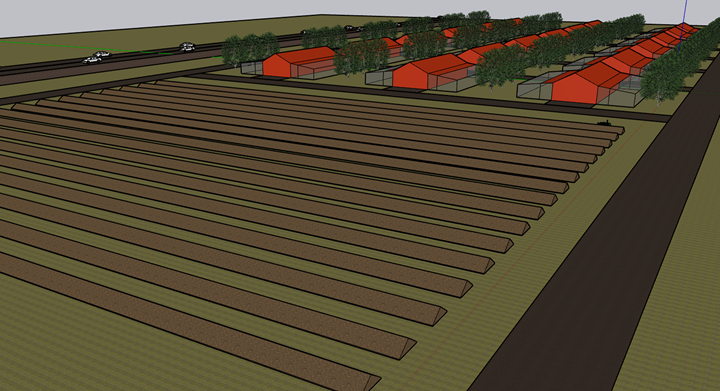

Project Images

1. Investment Highlights

-

Closed-loop revenue stack

Poultry, duck, rabbit, processing, logistics, and fertilizer combine into a diversified cash engine under one roof.

-

Quota-backed growth

New Entrant approvals and SII mentorship accelerate barn commissioning while protecting margin against commodity swings.

-

Fair Enterprise talent flywheel

Profit-sharing scorecards and the Stronach Academy produce owner-operators who stay to scale the network.

-

Replication-ready economics

Standardized 18-barn campuses plus shared services support a 10-site rollout targeting a $200M+ valuation.

2. Operating Model

A lean team of 19 employees runs the mixed-species complex. Profit-sharing scorecards, continuous-improvement rituals, and mentorship pipelines surface frontline insights directly into capital planning.

2.1 Workforce Plan

| Function | FTE | Key Duties |

|---|---|---|

| Chicken broiler barns | 3 | Feeding, welfare, catch/load coordination |

| Chicken layer barns | 2 | Egg collection, nesting care |

| Duck broiler barns | 2 | Water system upkeep, welfare |

| Duck layer barns | 2 | Egg collection, flock health |

| Rabbit barns (6 units) | 2 | Colony care, breeding management |

| Hatchery | 2 | Set, candle, pull, chick/duckling dispatch |

| Processor | 4 | Humane slaughter, evisceration, fabrication |

| Warehouse & logistics | 2 | Cold storage, order prep, deliveries |

| Total | 19 | — |

Compensation progression

Ontario's wage floor of $17.20/hr sets the baseline. Year 1 base rates reflect current CAD payroll allocations, while the Fair Enterprise employee pool (~$389K annually, ≈$20,487 per FTE) lifts total compensation well above starting salaries.

| Team lane | FTE | Year 1 base | Year 3 base | Year 5 base | Profit share / FTE | Profit share / team |

|---|---|---|---|---|---|---|

| Chicken broiler barns | 3 | $17.50/hr $36,400/yr ≈$56,887 with profit share |

$18.90/hr $39,312/yr ≈$59,799 with profit share |

$20.30/hr $42,224/yr ≈$62,711 with profit share |

≈$20,487 FY1 allocation |

≈$61,460 Shared across 3 |

| Chicken layer barns | 2 | $16.50/hr $34,320/yr ≈$54,807 with profit share |

$17.82/hr $37,066/yr ≈$57,553 with profit share |

$19.14/hr $39,811/yr ≈$60,298 with profit share |

≈$20,487 FY1 allocation |

≈$40,980 Shared across 2 |

| Duck broiler barns | 2 | $17.00/hr $35,360/yr ≈$55,847 with profit share |

$18.37/hr $38,189/yr ≈$58,676 with profit share |

$19.72/hr $41,018/yr ≈$61,505 with profit share |

≈$20,487 FY1 allocation |

≈$40,980 Shared across 2 |

| Duck layer barns | 2 | $16.50/hr $34,320/yr ≈$54,807 with profit share |

$17.82/hr $37,066/yr ≈$57,553 with profit share |

$19.14/hr $39,811/yr ≈$60,298 with profit share |

≈$20,487 FY1 allocation |

≈$40,980 Shared across 2 |

| Rabbit barns | 2 | $16.92/hr $35,200/yr ≈$55,687 with profit share |

$18.28/hr $38,016/yr ≈$58,503 with profit share |

$19.63/hr $40,832/yr ≈$61,319 with profit share |

≈$20,487 FY1 allocation |

≈$40,980 Shared across 2 |

| Hatchery | 2 | $17.00/hr $35,360/yr ≈$55,847 with profit share |

$18.37/hr $38,189/yr ≈$58,676 with profit share |

$19.72/hr $41,018/yr ≈$61,505 with profit share |

≈$20,487 FY1 allocation |

≈$40,980 Shared across 2 |

| Processor | 4 | $15.79/hr $32,840/yr ≈$53,327 with profit share |

$17.05/hr $35,467/yr ≈$55,954 with profit share |

$18.32/hr $38,098/yr ≈$58,585 with profit share |

≈$20,487 FY1 allocation |

≈$81,950 Shared across 4 |

| Warehouse & logistics | 2 | $15.47/hr $32,188/yr ≈$52,675 with profit share |

$16.71/hr $34,763/yr ≈$55,250 with profit share |

$17.96/hr $37,340/yr ≈$57,827 with profit share |

≈$20,487 FY1 allocation |

≈$40,980 Shared across 2 |

Compensation Summary

Base wages: $654,056/year (average $34,424 per FTE). Profit share: $389,248/year (average $20,487 per FTE). Total average compensation: ~$54,911 per employee.

2.2 Circular Fertilizer Program

Poultry litter, rabbit manure, and spent bedding are aerated with biochar to produce roughly 6,000 tonnes of composted fertilizer per year. Ontario market demand for regenerative soil amendments supports a $70 per tonne selling price, yielding $420,000 in annual revenue after certification testing and bagging.

A small packaging crew and third-party hauling add $75,000 in annual operating expense, but the closed-loop program keeps waste out of landfill, underpins Adena Farms Organic Campus soil health, and creates a branded input for partner farms.

3. Financial Summary

3.1 Current Site Performance

| Metric | Value |

|---|---|

| Gross revenue | $6,142,000 per year |

| Operating net profit (pre-CAPEX) | $3,892,481 per year |

| Average employee compensation | ~$54,911 per year |

| CAPEX facility | $7M per site (0% interest, 7-year straight-line) |

3.2 Unit Economics & P&L

| Metric | Value |

|---|---|

| Gross revenue | $6,142,000 |

| Operating expenses | $2,249,519 |

| Net operating profit (pre-CAPEX) | $3,892,481 |

| Net operating profit (post-CAPEX) | $4,892,481 |

| EBITDA margin (pre-CAPEX) | 63% |

| EBITDA margin (post-CAPEX) | 80% |

3.3 Revenue Composition

| Barn Group | Gross Revenue |

|---|---|

| 3 chicken broiler barns | $1,102,000 |

| 3 chicken egg barns | $495,000 |

| 3 duck broiler barns | $1,462,500 |

| 3 duck egg barns | $742,500 |

| 6 rabbit barns | $1,920,000 |

| Circular fertilizer products | $420,000 |

| Total | $6,142,000 |

Composting output: ~6,000 tonnes per year sold at $70 per tonne equals $420,000 of recurring revenue.

3.4 Capital Requirements

- $7M umbrella facility per site at 0% interest, repaid $1M annually over seven years.

- Construction sequencing activates barns, processor, and cold storage inside the first operating year.

- Appendix B details per-barn capital requirements.

| Project Element | Low Estimate | High Estimate |

|---|---|---|

| 18 barns | $3,510,000 | $5,940,000 |

| Processor & cold storage | $1,250,000 | $2,500,000 |

| Site total | $4,760,000 | $8,440,000 |

3.5 Fair Enterprise ROI Pathway

The chart below stages gross revenue and net profit through the first four operating years as barns, processing, and distribution come online. It also tracks the $7M CAPEX balance alongside the proportional Fair Enterprise allocations. CAPEX amortizes evenly over seven years; once repaid, net profit and each profit-share bucket gain the full $1M annual lift.

4. Fair Enterprise Governance

The Fair Enterprise operating system turns profit sharing into a strategic lever while embedding Frank Stronach's Economic Charter principles into daily operations. In 1957, Stronach opened a one-man tool-and-die shop in a rented Toronto garage. By inviting his foreman into one-third ownership instead of losing him, productivity soared and Magna International's ownership-sharing DNA was born. Magna ultimately grew to 180,000 employees and $40B in revenue on the strength of that model: 20% of profits to shareholders, 10% to employees (70% cash, 30% shares), 6% to management, 7% to research, 2% to charity, with the balance retained for taxes and reinvestment. Adena mirrors that playbook so every contributor becomes a partner in performance.

- 10% employee profit pool, distributed quarterly, creates transparency and shared accountability.

- Mentorship ladder promotes high performers into ownership roles, mirroring Magna’s foreman-to-partner pathway.

- Governance council with labor, management, ownership, and community seats approves budgets for R&D, social responsibility, and reinvestment.

- Advocacy mandate keeps small-business regulation workable and channels retained earnings into local resilience.

4.1 Profit Distribution Waterfall

| Category | Share | Allocation (Pre-CAPEX) | Notes |

|---|---|---|---|

| Shareholder dividends (ownership) | 20% | $778,496 | Stable annual return |

| Employee equity & profit pool | 10% | $389,248 | Distributed quarterly |

| Research & technology | 7% | $272,474 | Productivity & sustainability capex |

| Management participation | 6% | $233,549 | Leadership incentives & training |

| Social responsibility fund | 2% | $77,850 | Community & philanthropic commitments |

| CAPEX repayment | Fixed | $1,000,000 | Straight-line $1M/year (0% interest) |

| Reinvestment & taxes (SII) | Residual | $1,140,864 | Retained earnings, tax reserve |

| Total net operating profit | 100% | $3,892,481 | — |

4.2 Lessons from Frank Stronach’s Playbook

- Share the wealth, share the responsibility. When teams participate directly in profit, they stay and scale the enterprise instead of leaving to compete.

- Build a clear Charter of Rights. Transparent formulas for profit splits and employee treatment foster trust—Magna's Corporate and Employee Charters remain the blueprint.

- Think long-term. Sustained reinvestment in people, research, and community outruns quarter-by-quarter thinking and compounds value.

- Decentralize to stay entrepreneurial. Empowered divisions stay close to customers and continue improving margin, even as the network grows.

- Make Fair Enterprise the default. Economic democracies close the gap between investors and operators, keeping Adena's workforce aligned with the mission that took Magna from a garage to a global powerhouse.

5. Growth Strategy

- Add one new site every 12–18 months via federated ownership and shared services.

- Maintain margin discipline through centralized procurement, training, and QA while preserving operator independence.

- Scale the mentorship pipeline so each entrant graduates with Fair Enterprise governance fluency and capital support.

5.1 Network Growth Projection (10-Year Horizon)

Projected site rollout drives a steady climb in gross revenue while profit shifts from repayment obligations to post-repayment upside.

| Year | Active Sites | Gross Revenue ($M) | Net Profit During Repayment ($M) | Net Profit Post-Repayment ($M) | Notes |

|---|---|---|---|---|---|

| 1 | 10 | 61.4 | 38.9 | — | All sites in repayment |

| 2 | 20 | 122.8 | 77.8 | — | All sites in repayment |

| 3 | 30 | 184.3 | 116.8 | — | All sites in repayment |

| 4 | 40 | 245.7 | 155.7 | — | All sites in repayment |

| 5 | 50 | 307.1 | 194.6 | — | All sites in repayment |

| 6 | 60 | 368.5 | 233.5 | — | All sites in repayment |

| 7 | 70 | 429.9 | 272.5 | — | All sites in repayment |

| 8 | 80 | 491.4 | 272.5 | 48.9 | First 10 sites post-repayment |

| 9 | 90 | 552.8 | 272.5 | 97.8 | Years 1–2 cohorts post-repayment |

| 10 | 100 | 614.2 | 272.5 | 146.7 | Years 1–3 cohorts post-repayment |

Total Year-10 net profit: ~$419.2M combining repayment and post-repayment cohorts.

5.2 ROI Milestones

- CAPEX balance clears by the end of Year 7; net profit rises from $3.89M to $4.89M beginning Year 8.

- Shareholder dividends increase from ~$778K to ~$978K per site post-repayment.

- Employee profit pool expands from ~$389K to ~$489K; management participation grows from ~$234K to ~$294K.

- Owner-operator share (26%) climbs from ~$1.01M to ~$1.27M annually once CAPEX is repaid.

6. Implementation Roadmap

- Quota & Compliance (Months 0–3): Secure New Entrant approvals, finalize biosecurity protocols, and file the Fair Enterprise charter.

- Capital Deployment (Months 3–12): Construct 18 barns plus processor and cold storage; sequence utilities, structures, and equipment for staged commissioning.

- Talent & Mentorship (Months 6–12): Recruit 19 FTEs, launch the Stronach Academy cohort, and embed profit-sharing scorecards in onboarding.

- Closed-Loop Commissioning (Months 9–15): Synchronize hatchery-to-distribution workflow, activate waste-to-compost systems, and complete third-party food safety audits.

- Fair Enterprise Council Launch (Month 12): Seat representatives, approve R&D and community budgets, and publish the annual governance charter.

- Scale Replication (Months 12+): Package the site playbook, sponsor qualified employees into new entrant applications, and achieve 12–15% cost reductions on each subsequent build.

7. Appendices

Appendix A: Operating Expense Breakdown

Operating cost distribution highlights where $2.25M in annual site spend is concentrated.

Percentages reflect each category's share of steady-state operating expenses.

| Category | Annual OPEX |

|---|---|

| Feed and bedding | $850,463 |

| Utilities | $255,000 |

| Processing and packaging | $160,000 |

| Health and biosecurity | $70,000 |

| Repairs and maintenance | $185,000 |

| Fertilizer packaging & hauling | $75,000 |

| Labor (19 FTE @ $34,424) | $654,056 |

| Total | $2,249,519 |

Appendix B: Per-Barn Capital Detail

Capital mix (high estimate) emphasizes the dominance of building shells in per-barn budget planning.

Visualization uses the high-estimate scenario to illustrate allocation across major cost buckets.

| Category | Low Estimate | High Estimate |

|---|---|---|

| Site prep & utilities | $10,000 | $20,000 |

| Building construction | $150,000 | $250,000 |

| Equipment & systems | $30,000 | $50,000 |

| Permits & compliance | $5,000 | $10,000 |

| Per barn total | $195,000 | $330,000 |

Appendix C: Barn-Level Production Metrics

Revenue yield per barn shows rabbit and duck programs anchoring the production portfolio.

Chart depicts annual gross revenue contribution per barn across all livestock modalities.

| Barn Type | Units per Year (per barn) | Gross Revenue |

|---|---|---|

| Chicken broiler | 18,433 birds | $367,333 |

| Chicken layer (eggs) | 75,000 dozen | $165,000 |

| Duck broiler | 19,500 birds | $487,500 |

| Duck layer (eggs) | 75,000 dozen | $247,500 |

| Rabbit meat | 8,000 rabbits | $320,000 |

Appendix D: Image Gallery

Full-resolution visuals are presented in the image showcase near the beginning of this plan for quick reference during presentations or printouts.